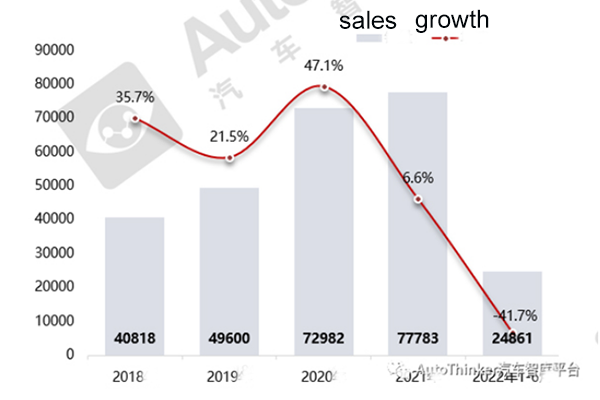

According to the data of the auto thinker, from 2018 to 2021, refrigerated trucks have maintained a "continuous increase" trend, but the sales declined for the first time in the first six months of this year.

| 2019 | 2020 | 2021 | Jan to Jun 2022 | |

| Sales (unit) | 49600 | 72982 | 77783 | 24861 |

| YOY growth % | 21.5 | 47.1 | 6.6 | -41.7 |

In the first half of this year, China's economic growth rate was only 2.5%, a decrease of 5.6 percentage points from 8.1% in the same period last year.

In the first half of this year, the epidemic broke out in many places, and the transportation of refrigerated trucks was hindered. In addition, the production and operation of supply-side vehicle companies were affected by the epidemic, and some orders in progress could not be delivered in time.

In the first half of this year, the freight market was very sluggish, and the oil price continued to rise, so the demand for refrigerated trucks in the end market decreased.

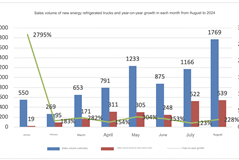

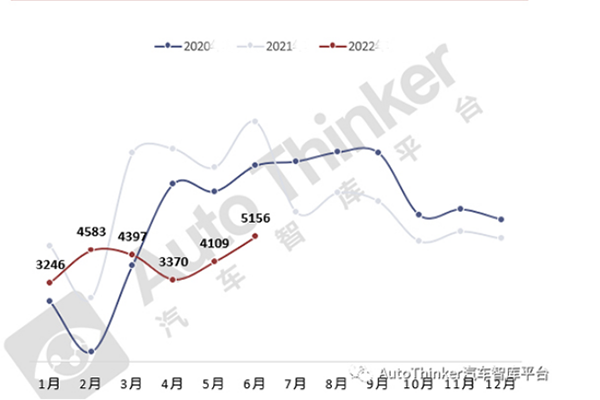

According to auto thinker platform and terminal licensing information, the monthly sales of refrigerated trucks in the first half of 2022 and the year-on-year ratio:

| Jan | Feb | Mar | Apr | May | Jun | Jan to Jun | |

| Monthly sale (unit) | 3246 | 4583 | 4397 | 3370 | 4109 | 5156 | 24861 |

| YOY growth % | 0.34 | 45.1 | 0.22 | -65.8 | -58.1 | -47.9 | -41.7 |

| Proportion % | 13.06 | 18.4 | 17.7 | 13.6 | 16.5 | 20.74 | 100.0 |

To sum up, the sales volume of refrigerated trucks in the first half of the year showed consecutive increase year-on-year in the first quarter, but consecutive decline year-on-year in the second quarter. This is mainly because that the first quarter was not affected by the epidemic, and the national economic growth rate reached 4.8%, which was only 0.4% in the second quarter.

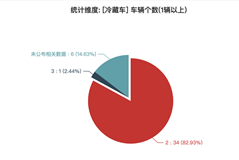

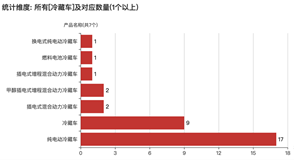

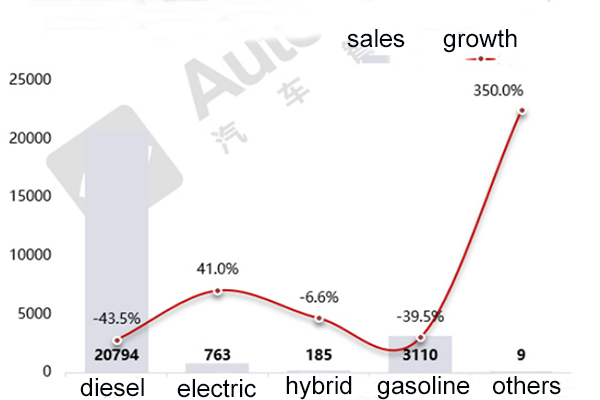

According to the data of the auto thinker, the sales, year-on-year and proportion statistics of various power refrigerated trucks in the first half of 2022 are as follows:

| Diesel | Gasoline | Electric | Hybrid power | Others | Total | |

| Sales from Jan to Jun 2022 (unit) | 20794 | 3110 | 763 | 185 | 9 | 24861 |

| Sales from Jan to Jun 2021 (unit) | 36803 | 5139 | 541 | 198 | 2 | 42643 |

| YOY growth % | -43.5 | -39.5 | 41.0 | -6.6 | 350.0 | -41.7 |

| Sales proportion from Jan to Jun 2022 % | 83.6 | 12.5 | 3.1 | 0.74 | 0.036 | 100.0 |

| Sales proportion from Jan to Jun 2021 % | 86.3 | 12.1 | 1.26 | 0.46 | 0.0047 | 100.0 |

| YOY in-/decrease in proportion % | -2.7 | 0.4 | 1.84 | 0.28 | 0.0313 | 0.00 |

According to the terminal licensing data, the sales ranking of the top 10 refrigerated truck companies in the first half of 2022:

| Rank | Company | Sales from Jan to Jun (unit) | YOY growth % | Market share % | YOY in-/decrease in market share% |

| 1 | Foton Motor | 9759 | -50.5 | 39.3 | -6.9 |

| 2 | FAW Jiefang | 3170 | -23.9 | 12.8 | 3.0 |

| 3 | JAC | 2774 | -41.4 | 11.2 | 0.1 |

| 4 | Sinotruk | 2242 | -16.4 | 9.0 | 2.7 |

| 5 | Qingling Motors | 930 | -42.5 | 3.7 | -0.1 |

| 6 | JMC | 882 | -51.7 | 3.5 | -0.7 |

| 7 | Dongfeng Trucks | 841 | -67.5 | 3.4 | -2.7 |

| 8 | Dongfeng Motor | 821 | -1.20 | 3.3 | 1.4 |

| 9 | Shandong Auto | 741 | 65.4 | 3.0 | 1.90 |

| 10 | Chang’an Auto | 443 | -26.9 | 1.78 | 0.40 |

| Total | 24861 | -41.7 | 100.0 | 0.00 |

Overall, in the first half of this year, Foton dominated the list, with FAW Jiefang and JAC ranking second and third respectively; Shandong Automobile was the only company with positive year-on-year growth and FAW Jiefang increased its share the most and performed well.