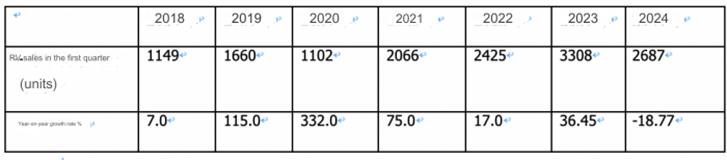

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

| Sales in Q1 | 1149 | 1660 | 1102 | 2066 | 2425 | 3209 |

| YOY growth% | 7 | 115 | 332 | 75 | 10 | 32.2 |

The pandemic has been contained, and the tourism market has recovered, showing an unusual vitality compared to the same period in recent years.

The government has introduced various policies to actively encourage tourism consumption.

People pay more attention to the privacy and safety of outbound tourism, and RVs can meet the needs of some consumers for privacy and safety, thereby promoting an increase in demand for RVs.

Top 10 RV companies by sales volume in the first quarter of 2023:

| Rank | Company | Sales in Q1 2023 | Sales in Q1 2022 | YOY growth |

| 1 | SAIC MAXUS | 431 | 243 | 77.4 |

| 2 | Yutong | 267 | 175 | 52.6 |

| 3 | Daide | 157 | 126 | 24.6 |

| 4 | Hubei Qixing | 149 | 85 | 75.3 |

| 5 | Hubei Heli | 126 | 71 | 77.5 |

| 6 | Lanzhong RV | 116 | 148 | -21.6 |

| 7 | Chery | 100 | 61 | 63.9 |

| 8 | Weier Tefen | 78 | 51 | 52.9 |

| 9 | Dachi RV | 74 | 48 | 54.2 |

| 10 | JMC | 72 | 50 | 44 |

| Industry | 3209 | 2425 | 32.3 |

In short, among the nearly 20 companies competing in the RV market, SAIC Maxus, Nanjing Automobile, and Jiangling Motors are in the first echelon of the industry, and their performance is relatively outstanding.

Top 10 regional rankings by sales volume in the first quarter of 2022:

| Rank | Region | Sales in Q1 2023 | Market share% |

| 1 | Jiangsu | 375 | 15.5 |

| 2 | Hubei | 206 | 8.5 |

| 3 | Shandong | 2204 | 8.4 |

| 4 | Zhejiang | 198 | 8.16 |

| 5 | Guangdong | 178 | 7.34 |

| 6 | Henan | 130 | 5.36 |

| 7 | Sichuan | 117 | 4.82 |

| 8 | Hebei | 90 | 3.71 |

| 9 | Shanghai | 89 | 3.67 |

| 10 | Liaoning | 88 | 3.63 |

| TOP 10 | 1675 | 69.1 | |

| Industry | 2425 | 100 |